- In linea con le aspettative, la Fed accelererà il tapering: il nuovo percorso definito porterà a zero acquisti netti entro metà marzo. La contrazione del bilancio non è stata ancora discussa, ma è probabile che avvenga più rapidamente che in passato.

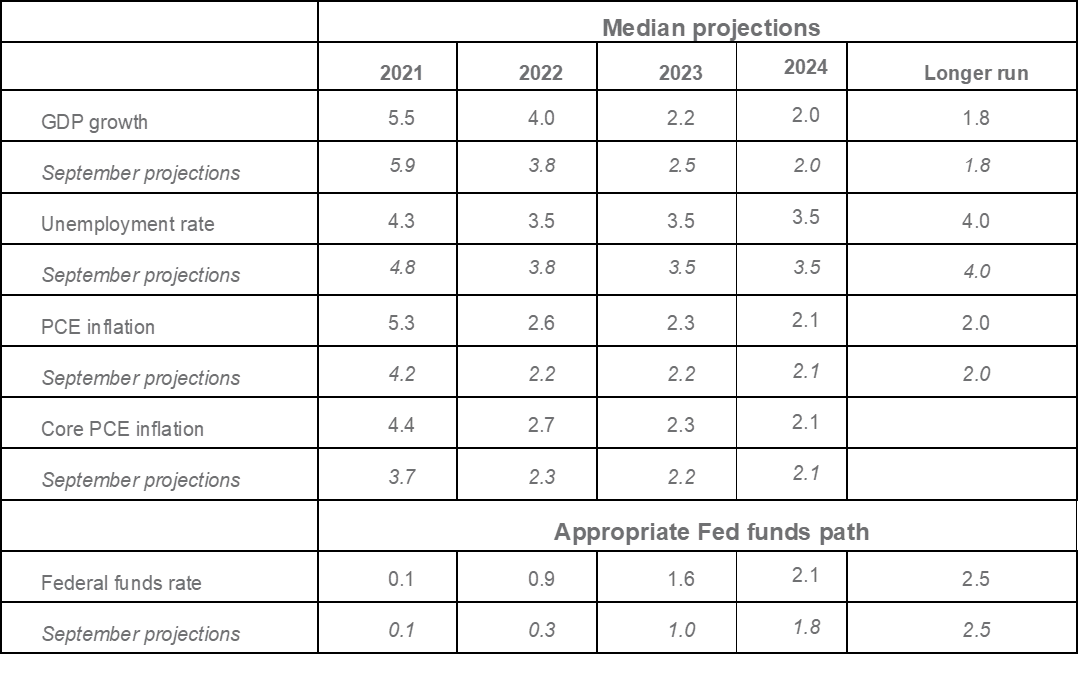

- Un mercato del lavoro senza precedenti e un persistente superamento dell’obiettivo di inflazione richiederanno, secondo il FOMC, tre rialzi dei tassi nel 2022, altrettanti nel 2023 e altri due nel 2024. Ciò dovrebbe consentire all’economia di continuare a crescere al di sopra del potenziale e con la disoccupazione a un minimo storico per tre anni.

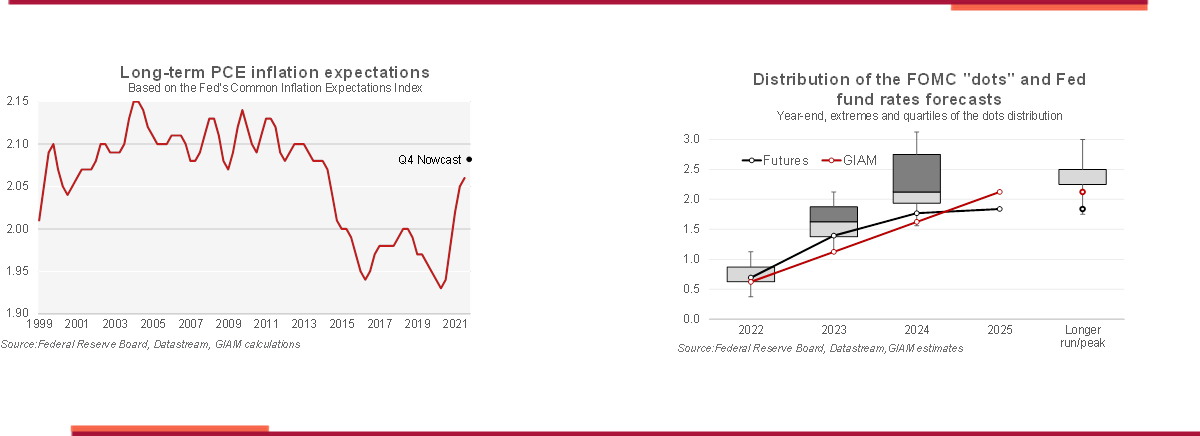

- Le proiezioni di inflazione per il 2022 sono state riviste sostanzialmente al rialzo e il ripido percorso dei tassi ufficiali annunciato mira a prevenire il disancoraggio delle aspettative, che ha sostituito la piena occupazione come priorità politica.

The widely announced hawkish pivot turned out to be more aggressive than expected by many. The Fed considers that the US economy is -and will be over the coming three years- strong enough to withstand not just the rapid end of bond purchases (which will stop by mid-March), but also eight rate hikes within three years. This is needed to prevent inflation from getting entrenched into expectation, something that would ultimately harm growth.

The change of tack is evident in the press statement, which highlights the strong improvement of the labour market and the continuing inflationary pressures. Interestingly the lengthy definition of the inflation goal was replaced by a simpler “inflation at the rate of 2 percent over the long run”, and it was stressed that this threshold has already being trespassed.

The Growth projection for 2022 year was revised up, but then growth is expected to slow down more markedly than in the September forecasts. FOMC members signal that unemployment rate can stay at 3.5%, a level reached only in February 2020, half a percentage point below the long-term value for three years in a row. Despite the ditching of the notion of “transitory”, inflation projections were revised up significantly only for 2022. Yet the FOMC continues to see price increase above the target for all the forecast horizon. It is too early to assess the impact of the Omicron variant on the economy, but Powell sounded quite optimistic, pointing to the fact the economy has become increasingly better at adapting to every new contagion wave.

In the press conference chair Powell explained at length the rationale of the hawkish pivot. First of all the labour market is running hot by almost any measure. The only notable exception is participation rate, but this is motivated to a large extent by residual fears of infection, caregiving obligation and in some cases, wealth effect allowing people to delay the return to the labour market. The speed at which these factors wane is highly unpredictable and much depend on the evolution of the pandemic.

With a strong confidence that full employment is within reach, the bulk of the Fed attention shifts to inflation. The initial, idiosyncratic price rises, Powell explained, have morphed into a more broad based phenomenon: moreover, wage pressures and the spike in house prices have yet to feed though consumer prices, and risk fuelling a further rise in expectations. Therefore, sustained inflation in conjunction with healthy growth allows for a strong reaction, which is consistent with the new inflation framework and with a risk management approach. More broadly, acting before the employment goal is reached is meant to show a tough stance on inflation, which should allow the Fed to be prepared for any possible scenario once the economy stabilises.

In term of measures the doubling of the speed of tapering was widely anticipated. With a strong labour market and demand driven inflationary pressures, adding accommodation is no longer needed. Delay the end of purchases was motivated by the need to minimise the risks of asset price volatility. Moreover, asset prices will react already to the announcement. And anyway, Powell stressed, we are only two meetings away from the end of net purchases The most relevant piece of news was the commitment to raise rates at a sustained pace over the next two years. A strong consensus has emerged on the need for three hikes next year and in 2023, followed by another two in 2024. This will bring the Fed funds rate 40 bps lower than the 2.5% equilibrium rate. Chair Powell said the situation is not comparable to the 2015 liftoff, after which the policy rate remained stuck for a year; the economy is now in a much stronger position, especially concerning the labour market.

A throughout discussion on the reduction of the balance sheet has not started yet, but Powell already hinted at that, as the economy is in a better shape than in 2015, the long period of time between the end of purchases (Q4 2014) and the reduction in the balance sheet (September 2017) will not be repeated.

As a reminder, only after raising the Fed funds rate for the fourth time, in June 2017 to 1-1.25%, the FOMC announced that runoff would start “this year.” It implemented it in September, when it paused the rate hikes, which restarted in December. Given that the estimated terminal rate has come down from 3% in 2017 to 2.5% we could expect that the reduction of the balance sheet could begin earlier, i.e. after three rate hikes. This means that quantitative tightening could start at the beginning of 2023 if the Fed sticks to its schedule of rate increases.

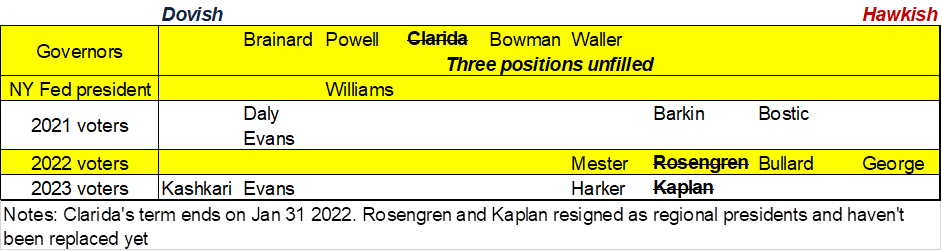

Our baseline scenario has currently a shallower path for the policy, entailing only two hikes per year. We expect growth to be overall less job rich than what the Fed sees and the large pile of debt may ultimately prevent a sizeable tightening in borrowing costs. However, given the strong commitment shown by the FOMC and the hawkish tilt in the composition of the pool voting members two hikes appear only marginally more likely than three for next year.

The initial reaction shows that market welcomed the Fed’s attempt to burnish its anti-inflation credentials The S&P gained 0.4% on the announcement. Breakevens dropped to the lowest level since October. Two year yields rose to 0.7%, the highest level in nearly two years and the 10 yr. to 1.46%.